First Time Homebuyer Program

First Time Homebuyer Loan Assistance

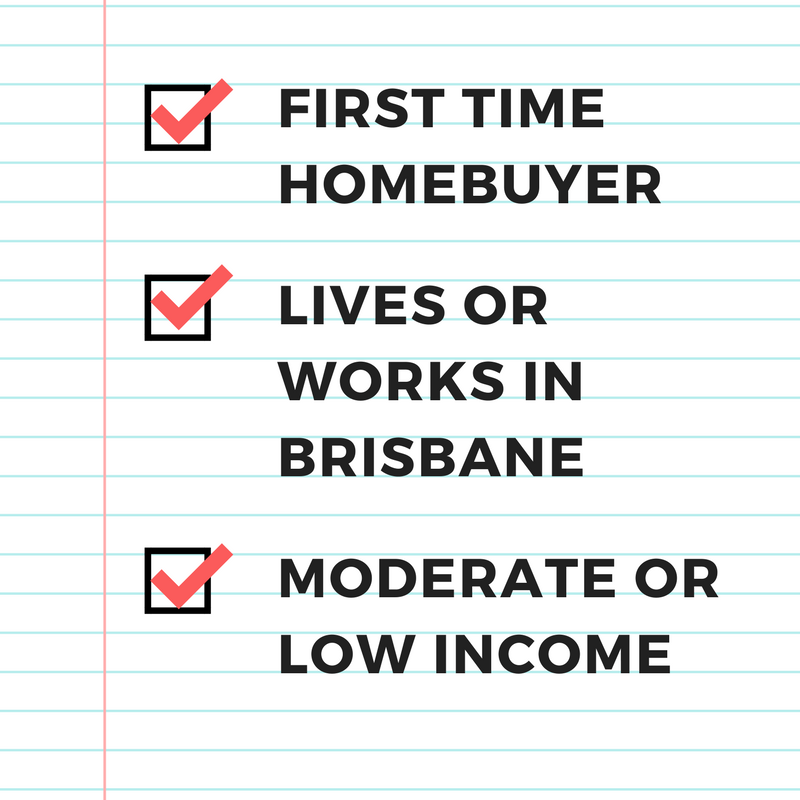

- At the time of filing an application have been a resident of Brisbane for at least one year; or

- Have an immediate family member (parent, child or sibling) who has been a resident of Brisbane for at least one year from the filing of an application; or

- At the time of filing an application, had their primary employment (largest source of income) located within the City of Brisbane for at least one year; or

- At the time of filing an application, their primary employer has been the Brisbane School District, the Jefferson Union High School District or the San Mateo County Community College District for at least one year.

Available Units: First Time Homebuyer Resale Program

| Address | Unit Type | Unit Size | Sq Ft | List Price | First Time Homebuyer Loan Available? | Eligibility Application Deadline |

| 1 San Bruno Ave., Unit D | Condo | 1 bd/ 1 ba | 775 | $500,269 | Yes; up to $200k |

CLOSED January 31, 2019 |

- Low and moderate income households (maximum two people) are eligible to apply for a First Time Homebuyer Loan of up to $200,000 to purchase the unit at 1 San Bruno Avenue, Unit D, which is available through the Housing Authority's First Time Homebuyer resale program.

- The eligibility application window for this unit closed on January 31, 2019.

How the program works

Interested homebuyers should fill out a First Time Homebuyer Program Waiting List application (the waitlist for new loans is currently closed). When a loan or resale unit for which the City can transfer an existing First Time Homebuyer loan is available, the City will hold a lottery of eligible households from the waiting list. To be eligible for the lottery, the household must meet the income level and household size requirements of the specific loan or resale unit. The winning lottery household will then move forward to apply for a first mortgage by a lender pre-approved for the program by the City, in addition to applying for the silent second mortgage from the City of Brisbane. The buyer will be required to make a down payment of at least 3% of the purchase price of the property and cover normal closing costs associated with the purchase of a home. The first mortgage lender may require a larger down payment.

Waiting List

To be eligible for the waiting list, you must currently meet at least one of the four eligibility criteria listed above, and qualify by income (see HCD's income limit chart). Note: you do not have to have lived or worked in Brisbane for at least one year in order for your name to be placed on the waiting list; however, this criteria must be met at the time of loan consideration.

Brisbane First Time Homebuyer Program

Brisbane, CA 94005

Eligible applicants are notified by mail that their names have been placed on the waiting list. *Update: The waiting list for new First Time Homebuyer Program loans is closed effective May 30, 2018.*

Additional information

- For a detailed description of the BMR program, please see the First Time Homebuyer Program Manual.

Upcoming First Time Homebuyer Workshops

- Wednesday, October 30, 2019 @ 6 PM: San Mateo County HEART/Meriwest Mortgage First Time Homebuyer Workshop. This workshop is for HEART's First Time Homebuyer program and is not affiliated with the City's program.